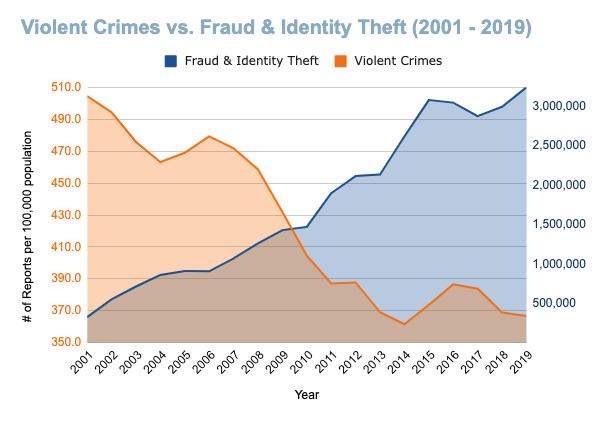

Over the past few decades, violent crime has plummeted: a cause for celebration. But to the dismay of the unsuspecting, something more insidious has risen to take its place: cybercrime.

Between 2001 and 2019, fraud and identity theft rapidly overtook violent crimes in the U.S. Based on data from the Police Executive Research Forum, the FTC’s Consumer Sentinel Network Data Book, and Statista, we created this visual to show that 21st century perpetrators are increasingly focused on our devices, data, and identities.

Approximately 64% of U.S. adults have experienced a cyber attack on their personal information or accounts—making it one of the most pervasive crimes today. By stealing your information, hackers are able to open bank accounts and apply for loans or credit cards (all in your name), and even extort you for more money by holding your data hostage. To top this off, officials are learning that the hardest type of crime to stop is the one they can’t see.

In ordinary times, cybercriminals cost Americans an estimated $50 to $100 billion each year. Now, during the Covid-19 pandemic, instances of cybercrime have skyrocketed. People across the world are suddenly working remotely—outside the safety of company firewalls. At the same time, cybercriminals are working unwatched, amid added privacy due to quarantine. For example, since January 2020, Google detected a whopping 350% increase in the number of phishing sites on the web. As noted in a recent report from the U.S. Department of Homeland Security, these sites are exploiting public fear of COVID-19 to gain access to sensitive data.

If COVID-19 and the current economic downturn have left your credit and finances in disarray, the last thing you need is to fall victim to cybercrime. Regal Credit Management can protect you and your credit from cybercriminals. Contact Regal today for more information.